What are mutual funds and should you invest in them? This is a common question for anyone new to investing. Mutual funds pool money from many investors and are managed by professionals who invest in a diverse portfolio of stocks, bonds, or other securities. By investing in a mutual fund, you gain instant diversification and professional management without needing to pick individual stocks.

For more insights on investment strategies, check out Centsara’s investing blog.

The Key Benefits of Mutual Funds

Professional Management

One major advantage of mutual funds is that you are paying professionals to manage your investments. Fund managers research, select, and monitor the investments to optimize returns. This is ideal for beginners who lack the time or expertise to manage a portfolio.

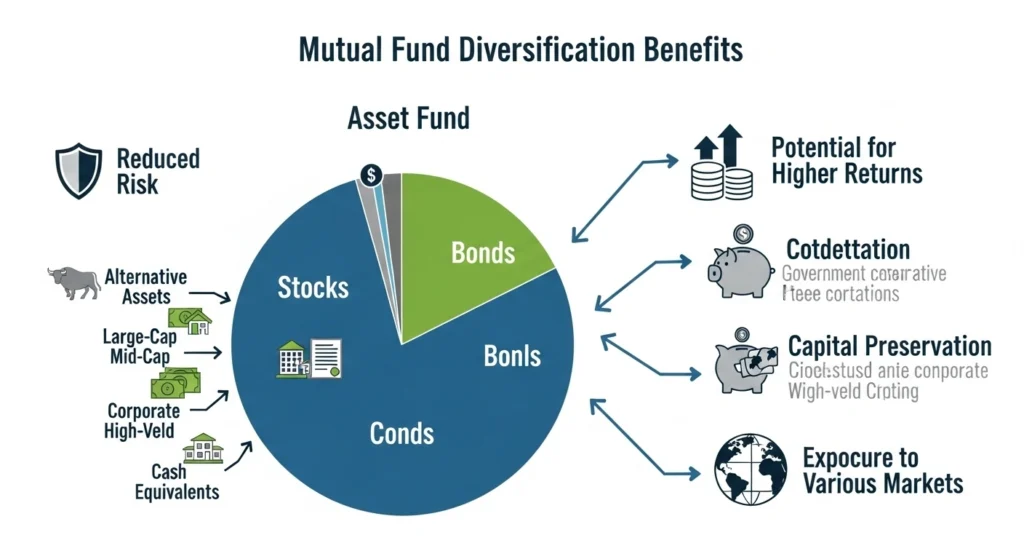

Diversification

Mutual funds spread your investment across many companies and asset types. This reduces risk because a poor-performing stock has less impact on the overall portfolio. Diversification protects your money and stabilizes returns.

Accessibility

Mutual funds allow small initial investments, making them accessible to beginners. They are also highly liquid, meaning you can buy or sell shares on any business day without hassle.

Drawbacks to Consider

While mutual funds offer many benefits, they do have some drawbacks:

- Fees: Management fees or expense ratios reduce overall returns. Always compare different funds before investing.

- Limited Control: You cannot choose specific stocks within the fund. You rely on the manager’s expertise.

How to Decide If a Mutual Fund Is Right for You

Mutual funds are ideal for:

Before investing, evaluate fees, fund performance, and investment goals. Check out Investopedia’s guide on mutual funds (DoFollow external link) for more tips.

Additional Resources

- Centsara Investing Blog – Internal link for more investment guides.

- Morningstar Mutual Fund Research – External DoFollow link.

- SEC Guide on Mutual Funds – External DoFollow link.