The Impact of Emotional Spending and How to Control It begins with understanding why it happens. Many people indulge in retail therapy after a stressful day, thinking a purchase will make them feel better. While it provides a temporary boost, emotional spending can negatively impact your finances and mental health if it becomes habitual.

Internal link suggestion: For tips on budgeting, check out Centsara’s Budgeting Tips.

External link suggestion: Learn more about impulse buying psychology on Psychology Today.

The Psychology Behind the Spend

Emotional spending triggers dopamine release, providing a brief sense of happiness or control. Stress, sadness, or anxiety often cause this behavior, but positive events like a promotion can also lead to impulse purchases. Unfortunately, the happiness is fleeting, and guilt usually follows when the bill arrives.

Identifying Your Triggers

To regain control, first recognize your spending triggers. Journaling your purchases and noting your emotions can help identify patterns. Are you bored, lonely, or overwhelmed when you shop? Recognizing these moments allows you to develop healthier coping mechanisms.

Internal link suggestion: Explore Financial Journaling Tips to track your spending habits effectively.

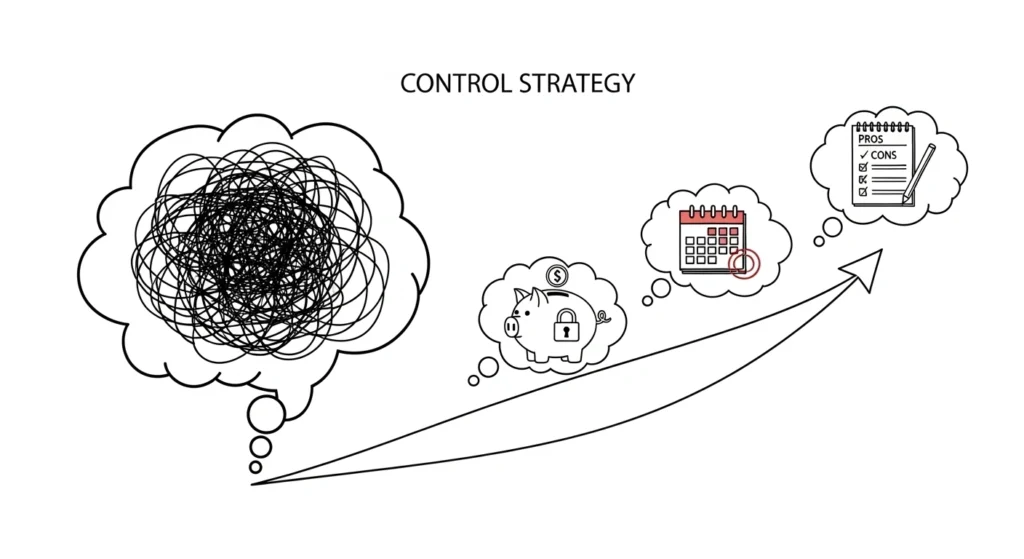

Strategies to Regain Control

Create a Cooling-Off Period

Give yourself a set amount of time before making a purchase. Small items: 1 hour; larger items: 24 hours. Often, the impulse fades, and you avoid unnecessary spending.

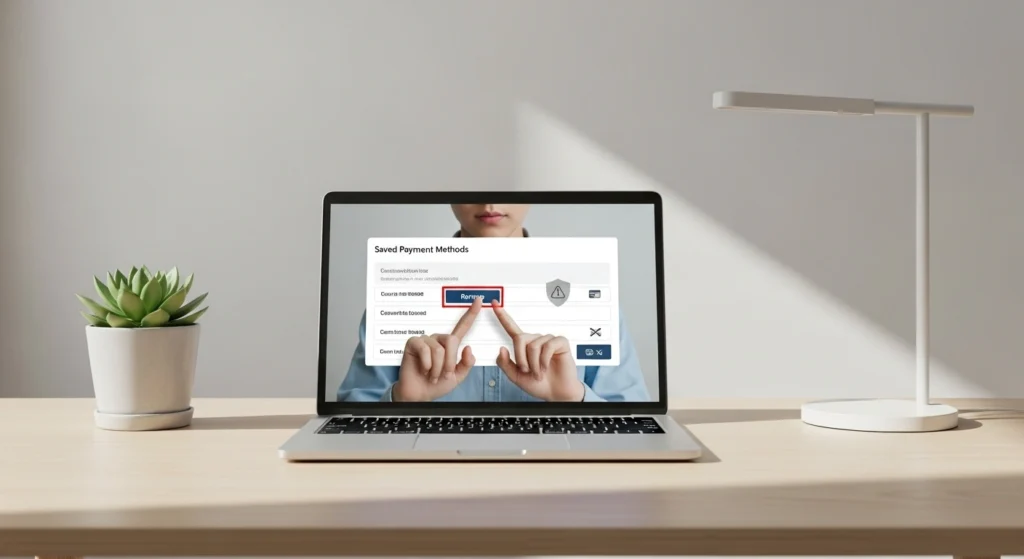

Make Spending More Difficult

Delete saved card information, unsubscribe from promotional emails, or use cash instead of cards. Physical money changes the psychological impact of spending.

Internal link suggestion: Check out Smart Spending Techniques.

Shift Focus to Financial Goals

Set exciting financial goals like saving for a house or vacation. Automatic transfers into a savings account reduce temptation and reinforce discipline.

External link suggestion: Learn goal-setting for finances on NerdWallet.

Conclusion

The Impact of Emotional Spending and How to Control It shows that impulsive purchases are a normal human behavior. By identifying triggers and implementing smart strategies, you can manage emotional spending and protect your financial future. Small, consistent changes lead to long-term financial and emotional wellness.