Okay, so real talk — when “money experts” tell you to save three to six months of expenses, it feels like they just told you to climb Mount Everest in Converse. Like, excuse me?? I’m just trying to pay rent, buy sushi with the girls on Friday, and maybe go on one decent vacation a year.

That’s why I’m obsessed with The 52-Week Incremental Savings Challenge: A Year-Long Path to Financial Growth. 💸 Instead of stressing over one huge number, you take baby steps every week. Week 1, it’s just $1. Week 2, $2. By week 52, you’re putting away $52. And when you finish? Congrats, babe, you’ve stacked $1,378.

Small steps → big money → stress-free glow-up.

💡 How the 52-Week Challenge Actually Works

It’s so easy it almost feels fake:

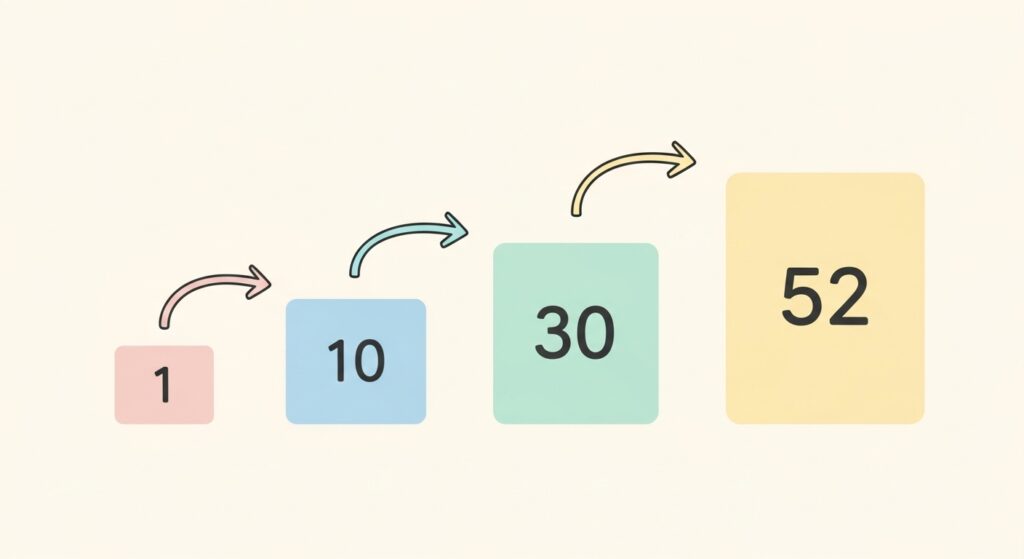

- Week 1 = $1

- Week 10 = $10

- Week 30 = $30

- Week 52 = $52

That’s it. No complicated spreadsheets (unless you’re into that). Just you, a jar or a savings account, and some weekly consistency.

✨ Pro tip: Treat it like a bill. Set up an automatic transfer every Friday. If your bank lets you name accounts, call it something fun like “Hot Girl Savings” or “Vacation in Cabo.”

🎯 Why This Works (Even If You’ve Failed at Saving Before)

Here’s the secret sauce: habit stacking.

That first $1 is so small it’s laughable. But your brain goes, “oh, we did the thing.” Week after week, it becomes a ritual. By the time you’re saving $30–$50, you’re already in the habit. It’s not “should I save?” anymore — it’s “I always save.”

Money experts on Centsara call this the psychology of incremental growth; small wins build momentum until the big wins feel natural.

🛍️ The Real Life Struggle: Holidays, School, Taxes

Let’s be real. November hits with Black Friday, December is gift-buying chaos, August means back-to-school, and property taxes sneak up at the worst times.

So don’t force it — flip the weeks.

- Save $5 in November when you’re broke from holiday shopping.

- Move that $48 week to February when you’re chilling after the holidays.

- Scale it to your life — even saving half ($689) is still a huge win.

This isn’t about perfection. It’s about progress.

🏦 Where to Park Your Savings (Without Accidentally Spending It)

Rule #1: Keep it separate. If it sits in your checking account, it’s gone.

Options that actually work:

- Open a savings-only account (community banks & credit unions often have no-minimum options).

- Apps with goal pots like Qapital or Chase’s saving goals.

- Credit union challenges — places like Navy Federal have seasonal savings clubs that align perfectly.

Check out Centsara’s budgeting tips for more ways to keep your money safe and growing.

⚡ Handling the Hard Weeks (40–52 = Ouch)

Let’s be honest — those $40–$52 weeks in the last quarter? They’re rough. That’s 43% of your total in just 3 months.

But don’t panic — here’s how to hack it:

- Prepay with windfalls. Got a tax refund? Bonus? Shove part of it into covering your hardest weeks.

- Make micro-cuts. Skip one dinner out = $30 saved. Cancel Hulu for 3 months = $30. Little swaps cover the gap.

- Reverse the challenge. Start with $52 and work your way down. It feels easier finishing with $1, $2, $3.

📱 Tech That Saves For You

We live in 2025 — let your phone do the work.

- Qapital → Round up your Starbucks order and drop the change into your challenge.

- Digit → Analyzes your spending, skims tiny amounts, and tucks them away.

- Bank of America Keep the Change → Classic round-up app, but it adds up.

- Google Sheets Trackers → Seeing the chart fill up is low-key addicting.

Pair these with your weekly deposits and you’ll breeze through the hard weeks.

🚨 When Life Blows Up (Because It Will)

Sometimes you just can’t hit the weekly number. Car repair. Job hiccup. Emergency vet bill. That’s life.

Instead of quitting:

- Catch-up method: Miss week 20 ($20)? Add $1 extra to the next 20 weeks.

- Percentage method: If your income drops 25%, reduce each week’s amount by 25%.

- Pause + resume: Even if you only save half the challenge, you’re still hundreds ahead of where you’d be otherwise.

👯♀️ Make It Fun With Friends & Family

- Do it with your BFF → weekly accountability texts.

- Couples → alternate weeks (he does odd, you do even).

- Kids → do a quarter-version ($0.25, $0.50, $0.75 …).

Turn it into a game and you’ll actually look forward to it.

🌱 Beyond the Challenge: Building Bigger Habits

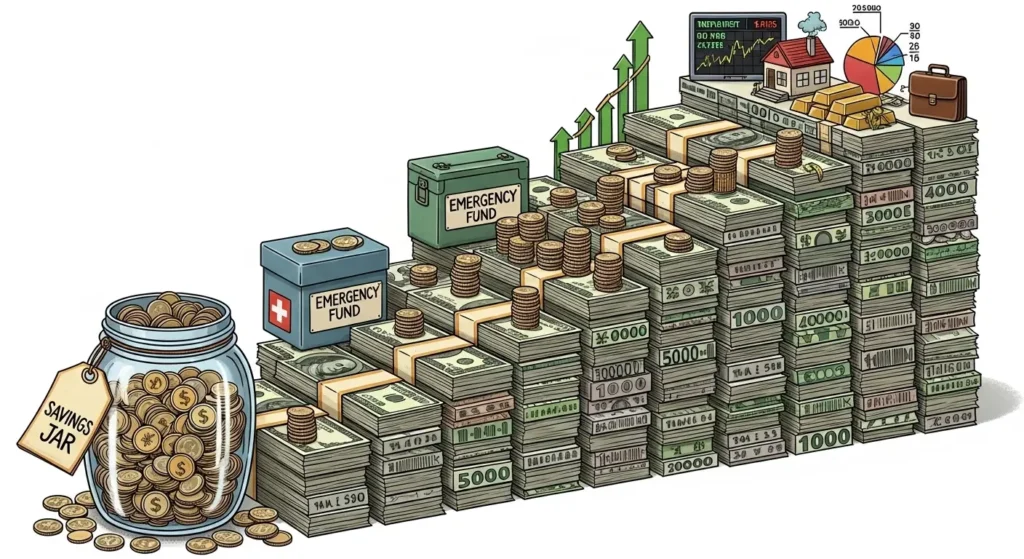

Here’s the glow-up nobody tells you: finishing this challenge isn’t just about the $1,378. It’s about proving to yourself you can stick to a system.

That confidence spills into:

- Building an emergency fund

- Starting investments (yes, you can start with $500)

- Paying off debt faster

- Feeling in control of your money instead of guilty about it

Think of this as your training wheels for bigger money moves.

🗓️ Best Times to Start

- January 1st → Classic “new year, new me” vibe.

- March 1st → Smart, because you finish in a low-spending February.

- September → Back-to-school = back-to-structure. Perfect reset point.

Truth is, the best time is literally whenever you decide. Week 1 can start tomorrow.

🔥 Quick Money Hacks to Boost Your Challenge

Because we all love shortcuts:

- Sell 3 things on Facebook Marketplace → boom, cover a week.

- Do a one-day gig (Uber, freelance, babysitting) → that’s 2–3 weeks covered.

- Use cashback apps (Rakuten, Honey, Ibotta) and throw the savings into your jar.

- Every time you skip Starbucks → drop $5 in. Call it the “latte fine.”

✨ Ready for Your Money Glow-Up?

This challenge works because it’s real-life doable. No crazy restrictions, no shame-y budgeting lectures. Just small steps that add up to something powerful.

A year from now, you’ll either have the same amount sitting in your account as today… or you’ll have $1,378 plus a brand-new saving habit that changes everything.

Your move, bestie. 💖

💡 Want more? Check out Centsara’s 52-Week Saving Challenge guide and their Budgeting & Saving section for extra hacks, trackers, and community tips.