You walk into a restaurant with a hundred items on the menu, but you have no idea what half of them are. The stock market can feel exactly like that overwhelming experience. Mutual funds offer a different approach—like ordering the chef’s special sampler platter instead of trying to pick individual dishes.

👉 For more investing basics, check out our personal finance insights at Centsara.

Understanding Mutual Funds

A mutual fund pools money from thousands of investors to buy a collection of stocks, bonds, or other securities. Think of it as a large basket where everyone contributes money, and a professional manager decides what to put in that basket.

When you buy shares in a mutual fund, you own a small piece of everything the fund holds. If the fund owns stock in Apple, Microsoft, and 500 other companies, you effectively own tiny portions of all those companies through your mutual fund shares.

👉 Learn how investing fits into long-term money planning at Centsara’s money management blog.

The fund manager makes the day-to-day decisions. They research companies, analyze market trends, and decide when to buy or sell. You pay them a fee for this service, typically ranging from 0.05% to 2% of your investment annually.

Types of Mutual Funds

Mutual funds come in many flavors:

- Stock Funds: Invest primarily in company shares. Aimed at long-term growth but more volatile.

- Bond Funds: Buy government and corporate debt, providing steady returns.

- Money Market Funds: Very safe, short-term investments.

- Target-Date Funds: Adjust portfolio based on retirement date.

👉 For deeper comparisons, you can read NerdWallet’s guide to mutual fund types.

The Case for Mutual Funds

Mutual funds have several advantages:

Instant diversification → Exposure to hundreds of securities.

Professional management → Experts handle the work.

Accessibility → Start with as little as $100.

Liquidity → Cash out any business day.

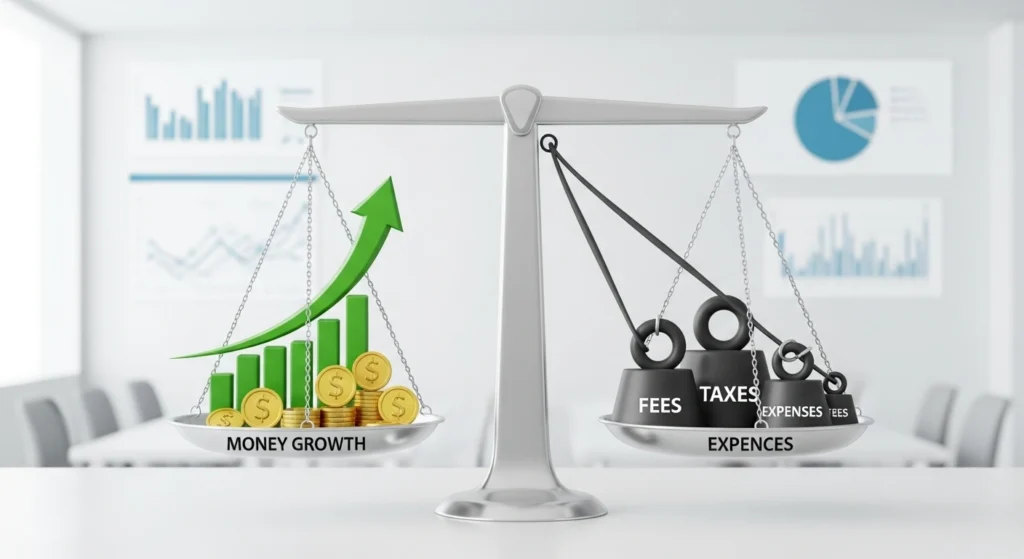

The Drawbacks to Consider

Despite benefits, there are drawbacks:

Fees eat into returns → Compounded losses over decades.

No control over holdings → You may own companies you dislike.

Tax inefficiency → Capital gains taxes even if your fund loses value.

Underperformance → Most funds fail to beat index benchmarks.

👉 Always weigh costs. Read Morningstar’s analysis on fund expenses.

Who Should Consider Mutual Funds?

Mutual funds are great for:

New investors → Built-in diversification.

Busy professionals → Low effort, automatic investing.

Smaller investors → Affordable way to access diversified markets.

Alternatives to Traditional Mutual Funds

If you want other investment options:

Index Funds → Lower fees, track indexes.

ETFs (Exchange-Traded Funds) → Trade like stocks, tax-efficient.

Individual Stocks → Full control, higher risk, more research needed.

👉 Compare strategies on Centsara’s investing guides.

Making Your Decision

When deciding if mutual funds are right for you:

Consider goals, risk tolerance, and time horizon.

Watch fees (0.5% vs 1.5% makes a huge difference long term).

Look for consistency over hype performance.

The Bottom Line

Mutual funds provide instant diversification, professional management, and accessibility—ideal for beginners and busy professionals. But fees and underperformance risks mean alternatives like index funds or ETFs often provide better long-term results.

The key? Match your investments with your goals, timeline, and risk tolerance.

👉 Want more personal finance strategies? Visit Centsara’s expert financial guides.