Understand What Lifestyle Inflation Is

It’s a scenario many dream of: getting a raise, landing a higher-paying job, or starting a profitable side business. Naturally, when your income grows, there’s a temptation to upgrade your lifestyle. This tendency is called lifestyle inflation, where spending rises along with income.

A little celebration is fine, but unchecked lifestyle inflation can erase the financial benefits of a higher paycheck. Suddenly, you might feel like you’re no better off than before.

Lifestyle inflation often starts subtly. You might:

Order takeout more often

Upgrade your car with a higher monthly payment

Move to a more expensive apartment

Individually, these changes seem manageable. But combined, your extra income gets absorbed, leaving you with no additional money to save or invest. Essentially, you’re running faster on the financial treadmill but staying in the same place.

Internal Link Example: Learn more about smart budgeting strategies for long-term wealth.

Create a New Budget

When your income rises, revisit your budget immediately. Don’t let extra money sit idle in your checking account — give it a purpose.

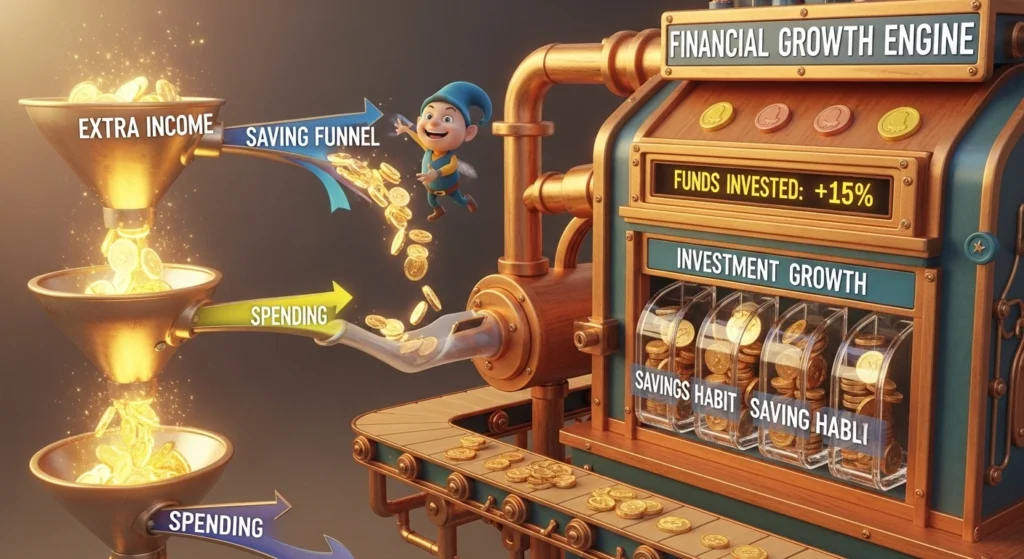

A proven strategy is the “save first, spend later” approach:

Decide on a percentage of your raise to save or invest.

Example: From a $500 raise, put $300 into a high-yield savings account or investment fund, leaving $200 for discretionary spending.

This ensures your wealth grows first, then your spending adjusts second.

External Link Example: Check out this guide on budgeting after a raise for actionable tips.

Automate Your Savings

Automation is one of the simplest yet most powerful tools to fight lifestyle inflation. Set up automatic transfers from your checking account to savings or investment accounts.

Benefits include:

Reduces the temptation to spend extra income

Turns saving into a seamless habit

Helps you consistently invest for long-term growth

Internal Link Example: Discover top automated savings tools that make this process easy.

Distinguish Needs from Wants

When earning more, it’s easy to confuse wants with needs. Examples:

A luxury car vs. a reliable car

Premium gym membership vs. essential fitness routines

Before committing to recurring expenses, ask: “Is this essential?”

Prioritize using extra income to:

Pay off high-interest debt

Build an emergency fund

Invest for the future

Once these priorities are secure, allocate a portion to treat yourself. This approach lets you enjoy your success without jeopardizing financial stability.

External Link Example: Learn how to track and categorize spending to make smarter financial decisions.

Final Thoughts

Avoiding lifestyle inflation is all about intentional financial decisions. By understanding the risks, creating a budget, automating savings, and distinguishing needs from wants, you can grow your wealth even as your income rises.

Start 2025 with a plan to maximize your raise or extra earnings without falling into the trap of lifestyle inflation.