How to Avoid Common Investing Mistakes Beginners Make 2025 ; Embarking on the journey of investing can be intimidating, especially for beginners. The financial world often seems filled with jargon and complicated strategies. But you don’t need to be a Wall Street expert to get started.

The most successful investors, even those with humble beginnings, avoid a few common investing mistakes beginners make that can derail a portfolio before it even gets off the ground. By understanding and steering clear of these pitfalls, you can build a solid foundation for long-term financial growth.

👉 Related reading: Beginner’s Guide to Building Wealth

Mistake 1: Investing Without a Plan

One of the biggest mistakes a new investor can make is to jump in without a clear plan. It’s like setting out on a road trip without a map or a destination in mind.

Before you invest a single dollar, define your goals. Are you saving for a down payment on a house in five years? Or building a retirement fund for the next 30 years? Your goals will determine what you invest in and how much risk you can take.

💡 For short-term goals, consider safer investments. For long-term goals, a bit more risk is acceptable since you have time to recover from market downturns.

Taking Command of Your Finances in 30 Days or Less

Mistake 2: Chasing Hot Stocks

The news is constantly talking about the latest “hot stock.” It’s tempting to jump in, but this is one of the quickest ways to lose money.

When a stock is already trending, the price has usually peaked. Smart investors know that wealth comes from long-term growth, not short-term hype.

Instead of gambling, build a diversified portfolio of reliable companies, ETFs, and index funds.

Morningstar Blog – Why Chasing Hot Stocks Fails

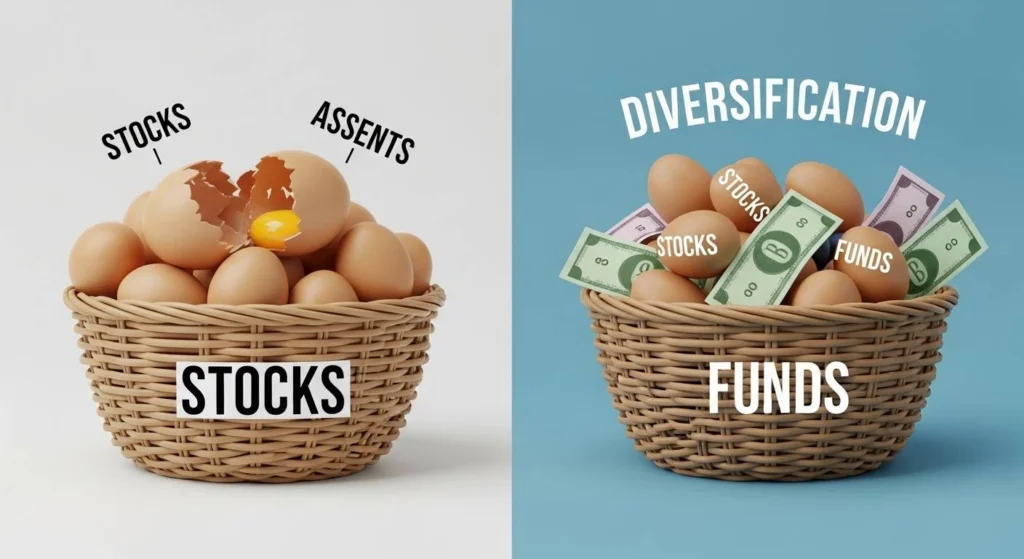

Mistake 3: Ignoring Diversification

Putting all of your money into one stock—or one type of investment—is a dangerous move.

Imagine you invest all your savings in one company, and it suddenly crashes. Your entire portfolio would be wiped out. Diversification protects you by spreading risk across stocks, bonds, and funds.

A great way to diversify is through index funds or ETFs, which hold hundreds of stocks. If one struggles, others help balance it out.

👉 Internal link: Beginner’s Guide to ETFs

Mistake 4: Panic Selling

The stock market always has ups and downs. Selling out of fear during downturns is almost always the wrong move.

When you sell at a loss, you lock in that loss. Historically, markets recover and reward patient investors. The most successful ones ride out volatility and stick to their long-term plan.

👉 Why Long-Term Investing Works

Final Thoughts

The key to success is avoiding these common investing mistakes beginners make: not having a plan, chasing hype, failing to diversify, and panic selling.

If you commit to steady, disciplined investing, you’ll build wealth over time—without falling into beginner traps.

👉 Want more? Check out: Best Beginner Investment Strategies