How to Evaluate Stocks Before You Buy Them is a critical skill for any serious investor. Navigating the stock market can feel like trying to find your way through a dense forest without a map. Before you buy a stock, it’s essential to do your homework. This process, known as stock evaluation, helps you move beyond simply picking a familiar name and instead make a thoughtful, informed decision.

It’s the difference between gambling and investing. While no method guarantees a winning stock, a solid evaluation process helps you identify companies that are financially sound with strong growth potential.

For more money management tips, check out Centsara’s personal finance guides.

Understanding the Company’s Business

The first step in how to evaluate stocks before you buy them is to truly understand the company’s business model.

Ask yourself:

- How does it make money?

- Who are its customers?

- What makes its product or service unique?

For example, Apple makes and sells phones and computers—a simple, transparent business model. If a company’s business is too complex to understand, it may be better to avoid it.

Also, examine the industry trends. Is it a growing market like renewable energy, or a shrinking one like traditional print media? Understanding this big picture helps gauge potential.

For deeper insights, read this Investopedia guide on stock research.

Looking at Key Financial Numbers

Once you understand the business, the next step in how to evaluate stocks before you buy them is reviewing the company’s financial health. You don’t need to be a CPA—just focus on key metrics:

Revenue and Profit

Is revenue consistently growing? Is the company profitable? Profits signal financial health and operational success.

Debt Levels

A high debt load can be a red flag. Look for companies that can manage debt comfortably without financial strain.

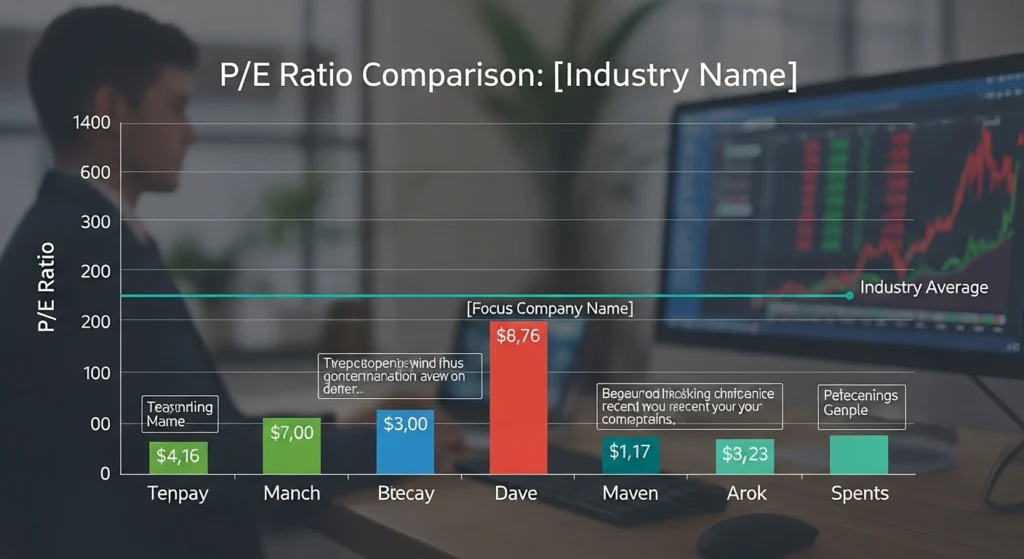

Price-to-Earnings Ratio (P/E Ratio)

This popular metric shows how much investors pay per dollar of earnings. Compare it with competitors in the same industry for context.

You can learn more about financial ratios from this Nasdaq beginner’s guide.

Considering the Management and Future

The final piece in how to evaluate stocks before you buy them is looking at leadership and future prospects.

Questions to ask:

- Does the management team have a proven track record?

- Is the company innovating?

- Does it have a strong competitive advantage, like patents or brand loyalty?

A capable leadership team can navigate downturns and seize opportunities. Likewise, companies with a strong competitive moat tend to thrive long-term.

For related investing tips, see Centsara’s investing section.

Final Thoughts on Stock Evaluation

By following a structured approach to how to evaluate stocks before you buy them, you’re making informed decisions instead of emotional ones.

- Understand the business.

- Review the financials.

- Evaluate leadership and competitive strengths.

This process won’t guarantee profits, but it stacks the odds in your favor—turning you from a casual stock picker into a confident, strategic investor.