Table of Contents

- Why Irregular Expenses Can Break Your Budget

- The Power of Sinking Funds

- How to Set Up Your Sinking Funds

- Budgeting Tips for Long-Term Success

- Final Thoughts

How to Budget for Irregular Expenses Like Car Repairs

Financial planning often focuses on fixed monthly expenses like rent and utility bills. While that’s a great start, a truly robust budget accounts for the unexpected costs that inevitably pop up. These irregular expenses—car repairs, a new roof, or a sudden trip to the dentist—can completely derail your finances if you are not prepared. Instead of scrambling to find money when these events occur, a smarter approach is to plan for them in advance. This method turns a potential crisis into a manageable bump in the road.

Why Irregular Expenses Can Break Your Budget

Irregular expenses aren’t “if” expenses—they are “when” expenses. Ignoring them can lead to credit card debt, late payments, or even dipping into your emergency fund. According to Investopedia, Americans spend thousands annually on unplanned costs like car repairs and medical bills.

By including them in your budget now, you avoid the panic of last-minute money scrambling.

The Power of Sinking Funds

A sinking fund is a simple but powerful tool for managing irregular expenses. The idea is to set aside a small amount of money regularly into a dedicated account for a specific purpose. Unlike a general savings account—used for long-term goals or emergencies—a sinking fund is for planned but infrequent expenses.

Think of it like this: instead of waiting for your car’s brakes to give out and then panicking about the $500 repair bill, you can plan for it. If you know that car maintenance costs roughly $500 per year, you can save about $42 each month. By the time you need the repair, the money is already there—no debt, no stress.

💡 Pro Tip: Check out Centsara’s budgeting tips to learn how to build multiple sinking funds at once.

How to Set Up Your Sinking Funds

1. Identify Your Irregular Expenses

Make a list of all the costs you know will come up, even if you don’t know the exact date. Common examples include:

- Car maintenance and repairs

- Annual insurance premiums (car, home, life)

- Holiday gifts

- Home repairs (water heater, leaky roof)

- Medical bills (check-ups, dental work)

- Vacations

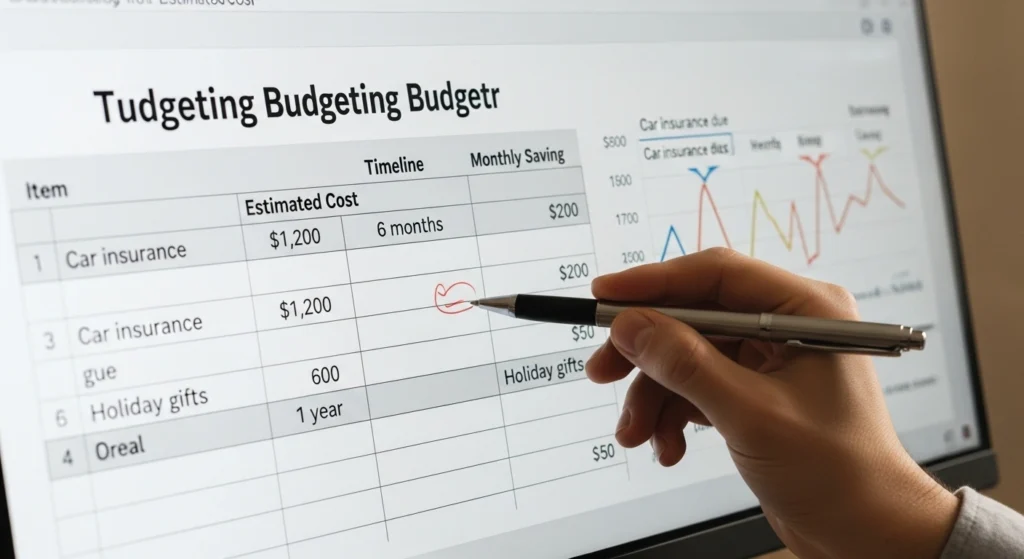

2. Estimate the Cost and Timeline

Once you have your list, try to estimate the cost of each item and when it is likely to occur. For example:

Car insurance due in 6 months = $1,200 → Save $200/month

Holiday gifts = $600/year → Save $50/month

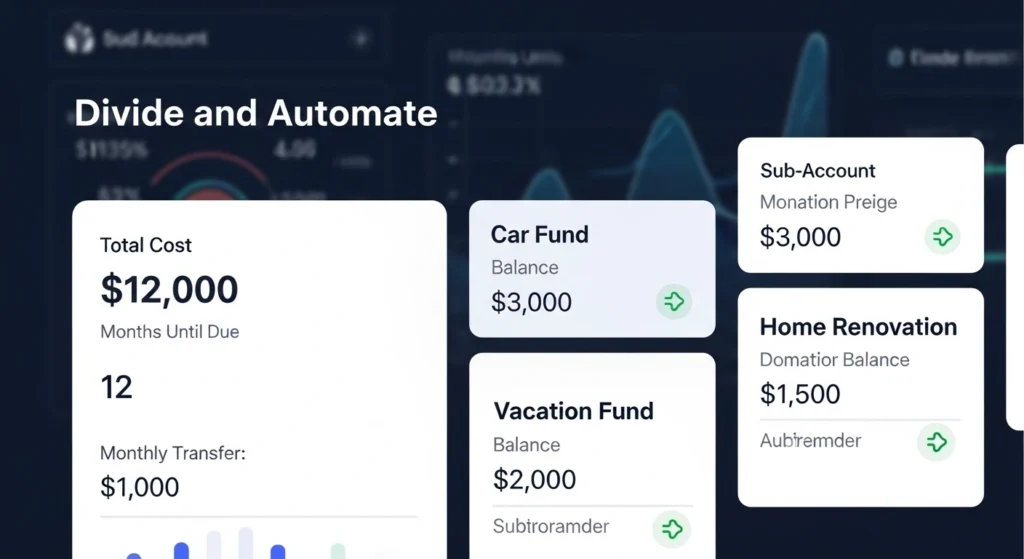

3. Divide and Automate

Take the total cost, divide it by the number of months until the expense is due, and automate transfers into separate accounts.

Many banks allow you to create sub-accounts with names like Car Fund or Vacation Fund.

📌 Learn more in this sinking fund guide.

Budgeting Tips for Long-Term Success

- Review Your Funds Monthly: Adjust amounts if your expenses change.

- Don’t Raid Your Sinking Funds: Keep them separate from your emergency fund.

- Overestimate Costs: It’s better to have extra than to fall short.

- Use High-Interest Savings Accounts: Earn interest while saving.

💬 For more strategies, see Centsara’s financial planning resources.

Final Thoughts

By using sinking funds, you are not just reacting to unexpected costs—you are proactively managing them. This gives you more control, reduces financial stress, and ensures your long-term money goals stay on track.