How to budget for irregular expenses like car repairs is essential for financial stability. While regular expenses such as rent or utilities are easy to track, unexpected costs — like a broken appliance, a surprise car repair, or annual insurance premiums — can throw a budget off track.

By planning for these expenses in advance, you take control of your finances and reduce stress. For tips on smart money management, check out Centsara’s budgeting resources.

Identify Your Irregular Expenses

The first step is to make a list of all expenses that don’t occur monthly but are predictable:

Car Maintenance: Oil changes, tire replacements, unexpected repairs.

Home Repairs: Roof leaks, broken water heaters, painting.

Annual Bills: Car insurance, property taxes, subscription renewals.

Medical Costs: Doctor visits, prescriptions, new glasses.

Holiday Spending: Gifts for family and friends.

Personal Care: Haircuts, gym memberships, clothing.

Listing these items helps transform surprises into planned-for expenses.

🔗 For more on personal finance planning, see this NerdWallet guide on budgeting for irregular expenses (DoFollow external link).

Calculate Costs and Set Up a Sinking Fund

Once you’ve identified your irregular expenses, estimate the annual cost for each and divide it by 12 to create a monthly sinking fund.

- Example 1: Car repairs cost $600 annually → $50/month saved.

- Example 2: Car insurance $1,200 annually → $100/month saved.

A sinking fund is a dedicated savings account for specific future expenses. It allows you to pay for big costs in small, manageable amounts without stress.

👉 Learn more about sinking funds in Centsara’s finance blog.

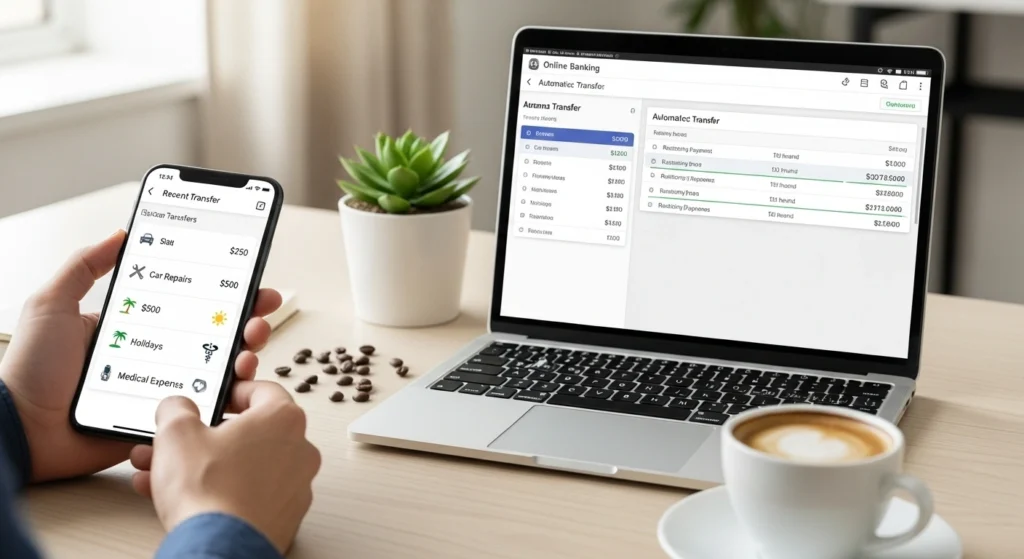

Automate Your Contributions

Automation ensures consistency. Set up automatic transfers from your checking account to your sinking fund each month.

- Create separate accounts or sub-accounts for different goals: “Car Fund,” “Holiday Fund,” or “Home Repairs Fund.”

- Your financial routine becomes stress-free, as unexpected expenses are already planned for.

This approach shifts your mindset: surprises are manageable, and major purchases feel like planned goals.

Benefits of Planning for Irregular Expenses

Financial Stability: Avoid sudden budget shortfalls.

Reduced Stress: Unexpected costs won’t derail your month.

Goal-Oriented Savings: You can achieve larger financial goals gradually.

Improved Money Management: Encourages smarter spending habits.

By proactively planning, you gain control over your money and handle financial surprises with confidence.

Additional Resources

- Centsara Budgeting Blog – Internal link to budgeting guides.

- NerdWallet on Irregular Expenses – External DoFollow link.