Table of Contents

- Introduction: Why Financial Planning for Weddings and Babies Matters

- Getting Started with Your Financial Plan

- Developing a Smart Savings Strategy

- Tackling Larger Financial Moves

- Essential Tips for Long-Term Financial Success

- Useful Resources and Tools

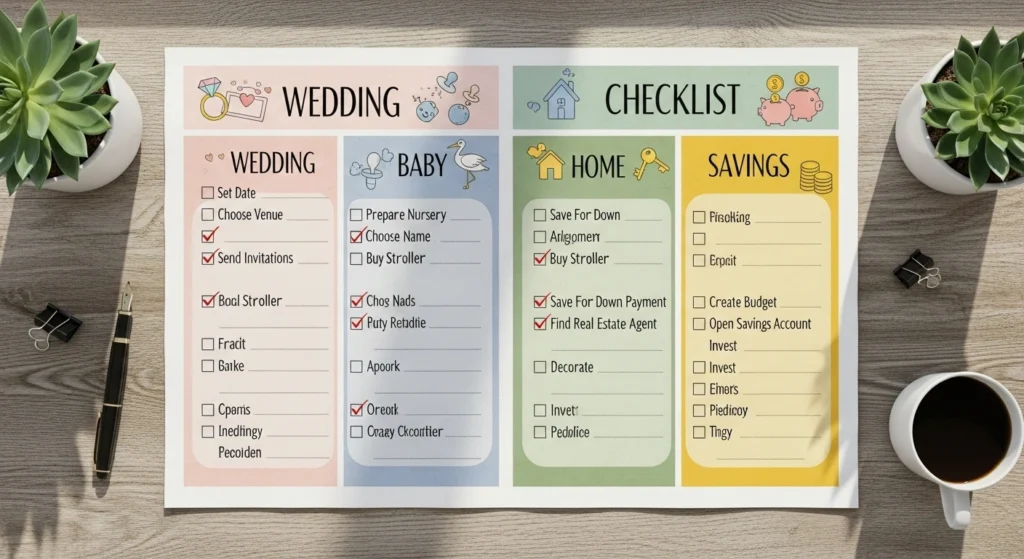

Introduction: Why Financial Planning for Weddings and Babies Matters

Life’s most significant moments—like a wedding or the arrival of a baby—bring immense joy but also major financial changes. Proper financial planning for weddings and babies ensures you enjoy these milestones without the stress of unexpected expenses. This ultimate guide will help you create a clear, actionable plan to prepare your finances, turning life’s big moments into cherished memories.

Getting Started with Your Financial Plan

The first step in financial planning for weddings and babies is setting clear goals. Understand exactly what you are saving for and how much it will cost.

- Weddings: Research costs for venues, catering, photography, and attire.

- Babies: Account for one-time purchases (crib, car seat) and ongoing costs (diapers, childcare).

- Other Life Events: Like buying a home, include down payments and closing fees.

Create a timeline for reaching your financial target — the more specific, the better.

Developing a Smart Savings Strategy

After defining your goal, evaluate your current spending. Cut unnecessary expenses such as daily coffee runs or unused subscriptions to free up cash.

Open a dedicated savings account—preferably a high-yield savings account—to keep your money safe and growing. Set up automatic transfers aligned with your payday to make saving effortless.

Consistency is key. The habit of saving regularly will dramatically improve your financial readiness for weddings, babies, or any other major life event.

Tackling Larger Financial Moves

Some milestones require more than saving money:

- Insurance Review: Ensure you have adequate life and health insurance coverage for your growing family.

- Estate Planning: Draft or update your will to protect your loved ones.

- Credit Score Boost: When buying a home, improve your credit by paying down debts and keeping up with timely payments.

These steps are essential in financial planning for weddings and babies and can save you thousands over time.

Essential Tips for Long-Term Financial Success

- Track Progress: Use budgeting apps like Mint (DoFollow) to monitor savings.

- Emergency Fund: Maintain 3-6 months of expenses to avoid financial setbacks.

- Consult Professionals: Financial advisors can provide personalized strategies for your unique situation.