Latest posts

-

How Student Loan Forgiveness Programs Work | Start Smart

How Student Loan Forgiveness Programs Work | Start Smart; For many Americans, a college degree is a path to a better life, but it often comes with a heavy price tag: student loan debt. The idea of having that debt completely wiped out can sound too good to be true. While it is not a…

-

The Impact of Closing Credit Accounts on Your Credit Score

On the surface, it seems logical. You have too many credit cards, so you close a few to simplify your financial life. Maybe you want to get rid of a card with a high annual fee or one that tempts you to overspend. While the intention is good, closing a credit account can have a…

-

How to Negotiate Lower Interest Rates on Credit Cards

How to Negotiate Lower Interest Rates on Credit Cards ; High credit card interest rates can drain your finances faster than a leaky bucket. The average American pays over 20% annually on credit card debt, yet many people never think to pick up the phone and ask for a better deal. Your credit card company…

-

Understanding Your Credit Report: What to Look For

Understanding your credit report: what to look for is a critical step in managing your finances. For many Americans, a credit report feels like a confusing document filled with jargon and numbers. But in reality, it is the story of your borrowing history something lenders, landlords, and even employers may review. Learning how to read…

-

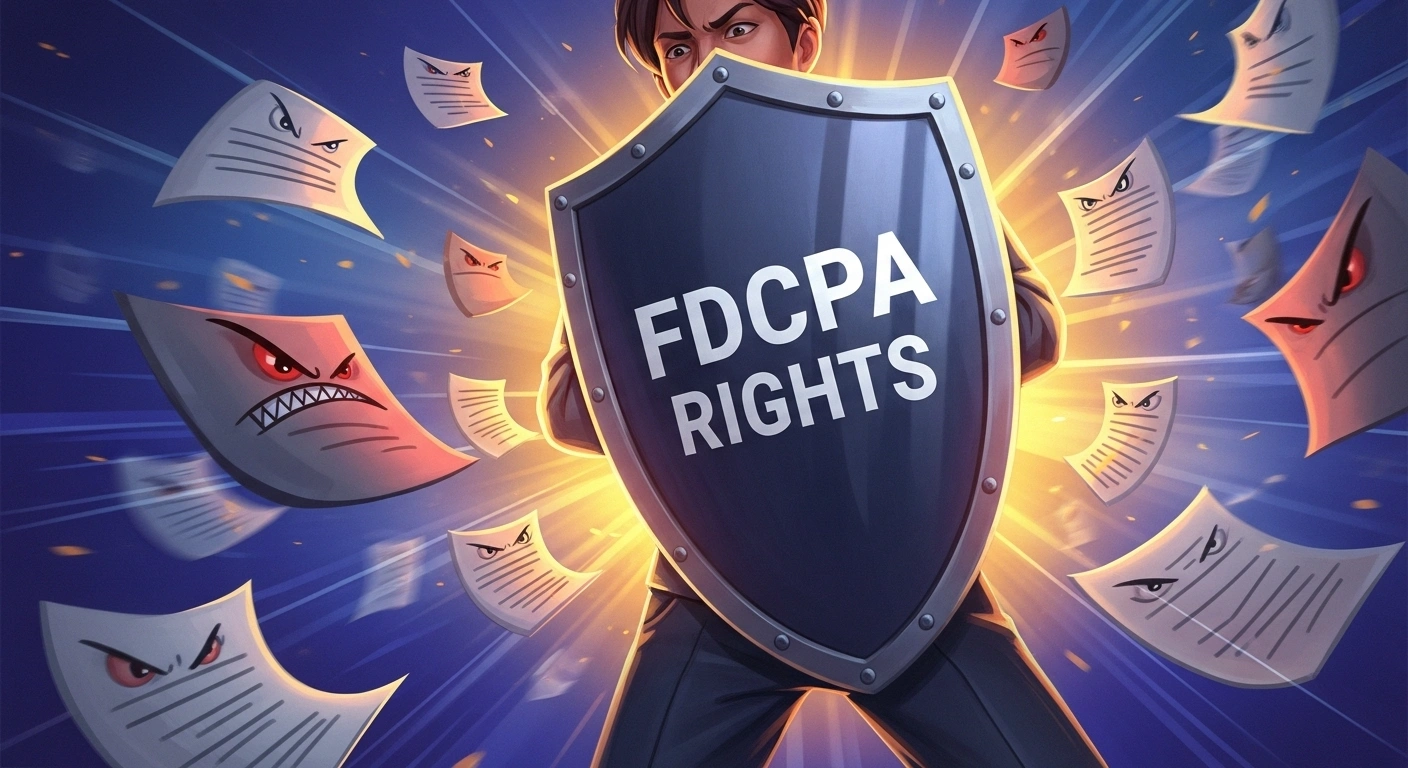

How to Deal with Debt Collectors Legally and Effectively 2025

How to Deal with Debt Collectors Legally and Effectively 2025 equips you with the legal rights, communication strategies, and dispute tools you need to feel in control, protect your rights, and move toward a more stable financial future. Table of Contents 1. Know Your Rights Under the Law The Fair Debt Collection Practices Act (FDCPA)…

-

How to Use a Secured Credit Card to Build Credit

Table of Contents What Is a Secured Credit Card? A secured credit card is different from a traditional credit card because it requires a security deposit. This deposit becomes your credit limit and protects the issuer from risk. This card is ideal for individuals with poor or no credit history, helping them gain access to…