Table of Contents

- Introduction to Financial Planning for Life Events

- Getting Started with a Financial Plan

- Developing a Savings Strategy

- Tackling Larger Financial Moves

- Long-Term Planning Tips

- Useful Tools and Resources

1. Introduction to Financial Planning for Life Events

Financial planning for life events like a wedding, having a baby, or buying your first home is essential to avoid financial stress. These moments bring joy, but they also come with significant costs. With the right preparation, you can enjoy these milestones while staying financially secure.

2. Getting Started with a Financial Plan

The first step in financial planning for life events is setting a clear, specific goal. Here’s what to consider:

- Weddings: Research average costs in your area. In the U.S., the average wedding in 2025 costs about $36,000.

- Babies: Expect one-time costs (cribs, car seats) and annual expenses (diapers, childcare), which can exceed $20,000 in the first year.

- Home Buying: Save for a down payment (avg. 9%) and closing costs (2–6% of the home’s price).

Once you know your target savings, build a timeline and break it into monthly goals.

3. Developing a Savings Strategy

🟢 Cut Unnecessary Expenses

Reduce spending on non-essentials like:

- Daily coffee shop visits

- Unused streaming subscriptions

- Impulse online purchases

🟢 Set Up a Dedicated Savings Account

Use a high-yield savings account for each goal. Automate transfers on payday to build savings without effort.

Consistency is key—regular savings habits dramatically increase your financial readiness for big events.

4. Tackling Larger Financial Moves

Some life events require more than saving. Here’s what to prepare:

🛡️ Insurance Coverage

- Ensure coverage suits your growing family

- Review your life and health insurance

📜 Estate Planning

- Draft or update your will

- Designate guardians and beneficiaries

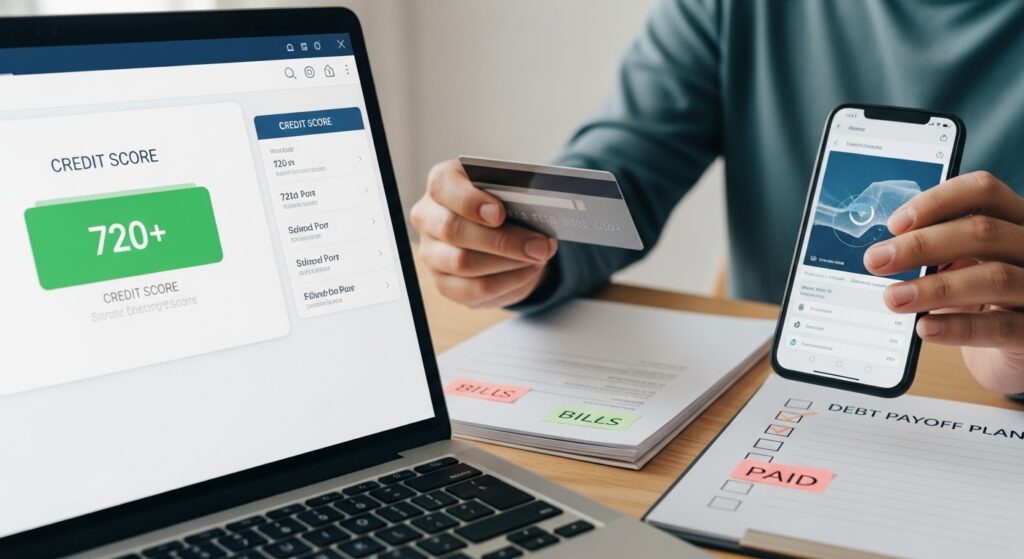

💳 Credit Score Boost

- Aim for a score of 700+ before applying for a mortgage

- Pay off existing debt

- Keep credit usage low

- Make all payments on time

5. Long-Term Planning Tips

📲 Track Progress

Use budgeting apps like Mint to monitor savings and goals.

🏦 Build an Emergency Fund

Save 3–6 months’ worth of expenses in a separate account for unexpected life changes.

💬 Consult Professionals

Meet with a financial advisor to create a personalized plan tailored to your income and lifestyle.

6. Useful Tools and Resources

🛠️ Tools to Try:

- NerdWallet Wedding Cost Calculator

- Baby Budget Planner by BabyCenter

- Zillow Mortgage Calculator

- Mint Budgeting App