Latest posts

-

How to Budget for Irregular Expenses Like Car Repairs

How to budget for irregular expenses like car repairs is essential for financial stability. While regular expenses such as rent or utilities are easy to track, unexpected costs — like a broken appliance, a surprise car repair, or annual insurance premiums — can throw a budget off track. By planning for these expenses in advance,…

-

Understanding Your Credit Report: What to Look For

Understanding your credit report: what to look for is a critical step in managing your finances. For many Americans, a credit report feels like a confusing document filled with jargon and numbers. But in reality, it is the story of your borrowing history something lenders, landlords, and even employers may review. Learning how to read…

-

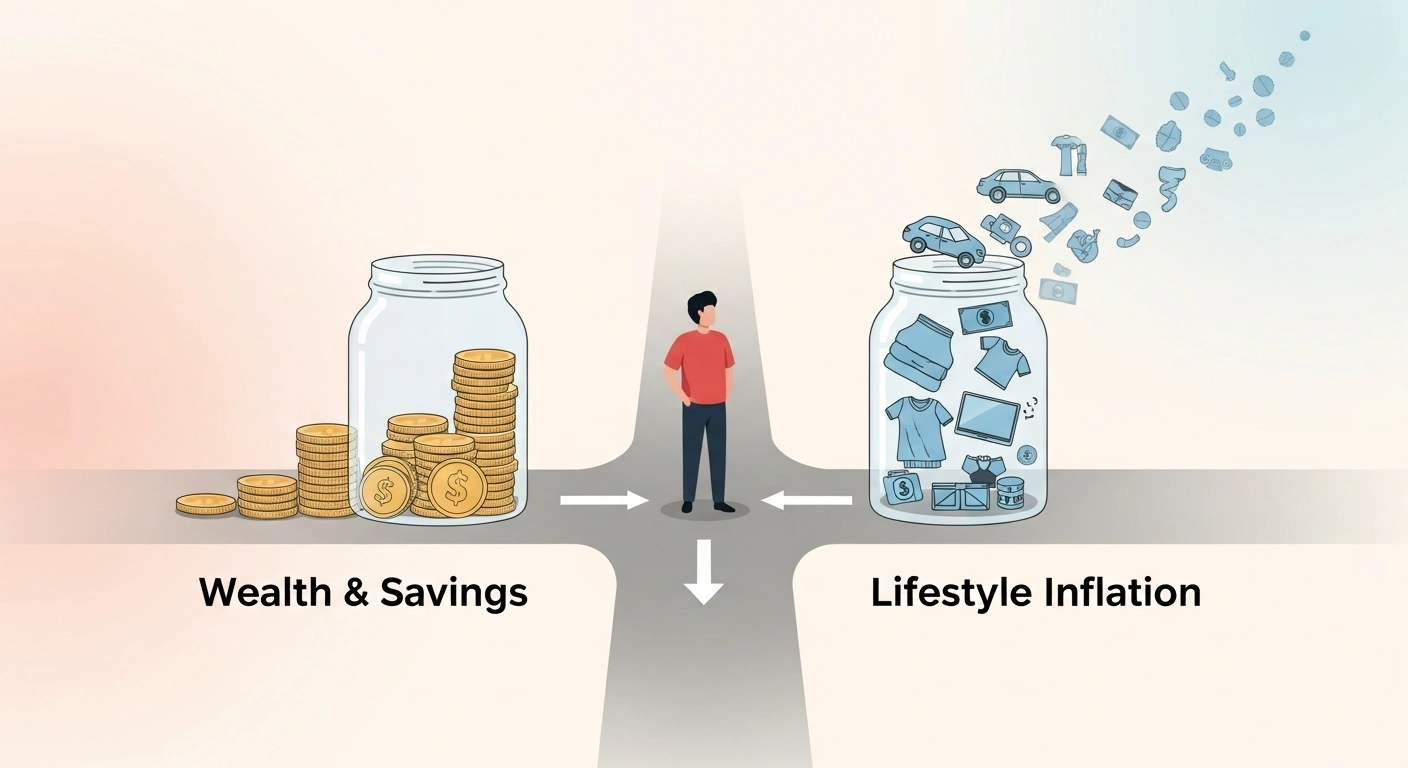

How to Avoid Lifestyle Inflation When Your Income Grows in 2025

How to Avoid Lifestyle Inflation When Your Income Grows in 2025 starts with understanding what lifestyle inflation is. Lifestyle inflation happens when your spending increases alongside your income. You start buying things you once considered unnecessary. The coffee shop visits become daily habits. The occasional dinner out turns into a weekly ritual. Before you know…

-

Avoid Lifestyle Inflation When Your Income Grows: Smart Money Tips

Understand What Lifestyle Inflation Is It’s a scenario many dream of: getting a raise, landing a higher-paying job, or starting a profitable side business. Naturally, when your income grows, there’s a temptation to upgrade your lifestyle. This tendency is called lifestyle inflation, where spending rises along with income. A little celebration is fine, but unchecked…

-

Earn More in 2025: Simple Ways to Increase Your Income

Table of Contents Making More Money Doesn’t Have to Be Complicated Making more money in the new year is a common goal, but it doesn’t have to be complicated. Many people assume they need a brand-new career or major life change to see a real difference in their income. In reality, there are simple, effective…

-

How to Evaluate Best Stocks Before You Buy Them in 2025

How to Evaluate Stocks Before You Buy Them is a critical skill for any serious investor. Navigating the stock market can feel like trying to find your way through a dense forest without a map. Before you buy a stock, it’s essential to do your homework. This process, known as stock evaluation, helps you move…

-

How to Budget for Irregular Expenses Like Car Repairs in 2025

Table of Contents How to Budget for Irregular Expenses Like Car Repairs Financial planning often focuses on fixed monthly expenses like rent and utility bills. While that’s a great start, a truly robust budget accounts for the unexpected costs that inevitably pop up. These irregular expenses—car repairs, a new roof, or a sudden trip to…

-

How to Deal with Debt Collectors Legally and Effectively 2025

How to Deal with Debt Collectors Legally and Effectively 2025 equips you with the legal rights, communication strategies, and dispute tools you need to feel in control, protect your rights, and move toward a more stable financial future. Table of Contents 1. Know Your Rights Under the Law The Fair Debt Collection Practices Act (FDCPA)…

-

The Best Apps to Manage Your Finances in 2025

The Best Apps to Manage Your Finances in 2025 are more powerful, intuitive, and accessible than ever before. Whether your goal is to budget smarter, save effortlessly, or monitor investments like a pro, these tools can help you take full control of your money. This guide explores top options for every type of financial need…