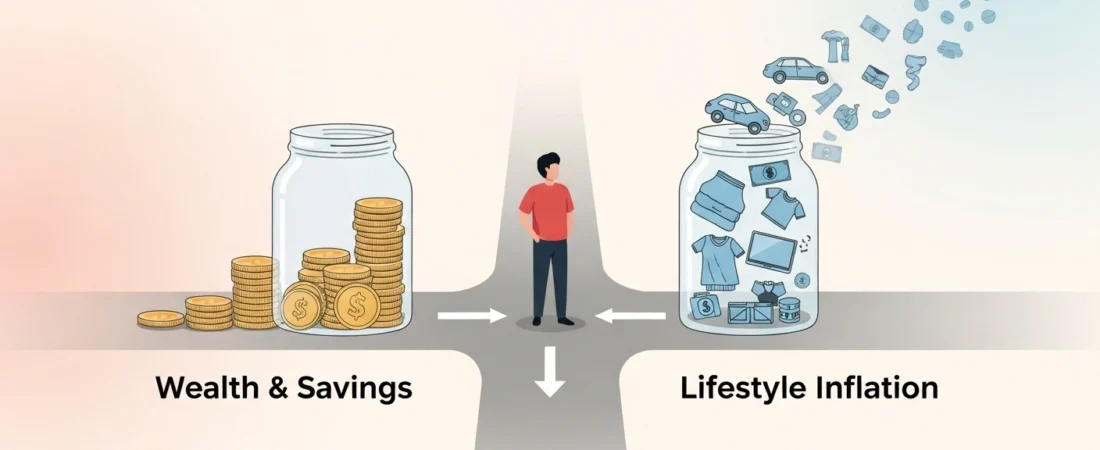

How to Avoid Lifestyle Inflation When Your Income Grows in 2025 starts with understanding what lifestyle inflation is. Lifestyle inflation happens when your spending increases alongside your income. You start buying things you once considered unnecessary. The coffee shop visits become daily habits. The occasional dinner out turns into a weekly ritual. Before you know it, your new income feels just as tight as your old one did.

This pattern affects people at every income level. A recent graduate making $35,000 faces the same temptation as an executive earning $150,000. The amounts change, but the behavior stays the same. Learn more about budgeting strategies here.

Why Does This Happen?

Human psychology works against us here. When we earn more, we naturally want to enjoy the fruits of our labor. We feel we deserve nice things after working hard for that promotion or new job. This thinking makes perfect sense.

Social pressure adds another layer. Friends, family, and coworkers often expect us to “live up to” our new income level. The colleague who suggests expensive restaurants assumes you can afford them now. Your neighbor notices when you still drive the old car despite your new position.

Mental accounting plays a role too. We tend to separate money into different categories in our minds. The raise feels like bonus money rather than part of our regular income. This makes it easier to spend without feeling guilty. Here’s an external resource explaining lifestyle creep in depth.

The Real Cost of Lifestyle Inflation

The numbers tell a stark story. Consider someone who earns $60,000 and saves 10% annually. That person puts away $6,000 each year. Now imagine they get a $20,000 raise but maintain the same savings rate on their original income. They still save only $6,000 annually while spending the entire raise on lifestyle upgrades.

Over 30 years, that missed opportunity costs them hundreds of thousands of dollars in potential wealth. The magic of compound interest works best when you feed it consistently growing contributions. Check this internal guide on investing basics.

Beyond the financial impact, lifestyle inflation creates a psychological trap. Higher fixed expenses mean less flexibility during tough times. Job loss, medical bills, or economic downturns become more threatening when your baseline expenses are high.

Practical Steps to Avoid the Trap

Pay Yourself First

When your income increases, immediately redirect a portion of the increase to savings and investments. Treat this like a non-negotiable bill. Many financial experts recommend saving at least half of any raise or bonus.

Set up automatic transfers to make this effortless. If your monthly income increases by $1,000 after taxes, automatically move $500 to savings before you have a chance to spend it. You can still enjoy the other $500 guilt-free.

Track Your Spending Closely

Awareness prevents most lifestyle inflation. Track every dollar for at least three months after a pay increase. Use whatever method works for you—apps, spreadsheets, or simple notebooks all work fine.

Look for patterns. Are you eating out more often? Buying more expensive groceries? Upgrading purchases you would have made anyway? Small increases across many categories add up quickly. Explore effective expense-tracking tips.

Set Specific Financial Goals

Vague intentions rarely survive contact with temptation. Instead of planning to “save more,” set concrete targets. Maybe you want to max out your 401(k) contribution or build a six-month emergency fund.

Write these goals down and review them regularly. When you feel tempted to increase spending, ask whether that purchase moves you closer to or further from your stated objectives.

Practice the 24-Hour Rule

Before making any non-essential purchase over a certain amount (perhaps $100 or $200), wait 24 hours. This simple delay often reveals whether you truly need or want the item.

For larger purchases, extend the waiting period. Consider sleeping on any decision that costs more than one week of your old income.

Maintain Some Old Habits

Keep driving the reliable car that got you to your new position. Continue shopping at the same grocery store. Stick with your current phone plan if it meets your needs.

This does not mean living like a monk. But maintaining some frugal habits provides stability and reminds you that happiness does not require constant upgrades.

Smart Ways to Enjoy Income Growth

Avoiding lifestyle inflation does not mean never spending money on yourself. The key is making intentional choices rather than sliding into expensive habits.

Consider upgrading items you use frequently and that impact your quality of life. A better mattress pays dividends every night. Quality work clothes might boost your confidence and career prospects.

Plan specific treats rather than making expensive choices your default. Take one amazing vacation per year instead of eating expensive meals every week. Buy the concert tickets you have always wanted rather than upgrading your entire entertainment budget. Check out this guide to guilt-free spending.

Building Wealth Instead of Lifestyle

The wealthy understand a simple truth: income is not the same as wealth. Wealth comes from the gap between what you earn and what you spend, multiplied by time.

Every dollar you avoid spending on lifestyle inflation becomes a dollar that can work for you through investments. That money grows over time, creating true financial security.

Think about your future self. The person you will be in 10 or 20 years will thank you for resisting the urge to spend every raise immediately. Financial freedom provides options that expensive possessions never can. Here’s a helpful breakdown of financial freedom steps.

When Life Changes, Adjust Gradually

Major life events—marriage, children, new cities—naturally require spending adjustments. The key is making these changes thoughtfully rather than using them as excuses for wholesale lifestyle upgrades.

When your family grows, yes, you need a bigger place. But do you need the biggest place you can afford? When you move to a new city, you might need a car. But does it need to be brand new?

The Long View

Avoiding lifestyle inflation is not about deprivation. It is about making conscious choices that support your long-term goals rather than just your immediate desires.

The habits you build around money will compound over time, just like your investments. Start with small, sustainable changes. Save half of your next raise. Track spending for one month. Set one concrete financial goal.

Your future self—the one with options, security, and genuine wealth—will thank you for every dollar you chose to save instead of spend. The temporary sacrifice of avoiding lifestyle inflation pays permanent dividends in financial freedom.